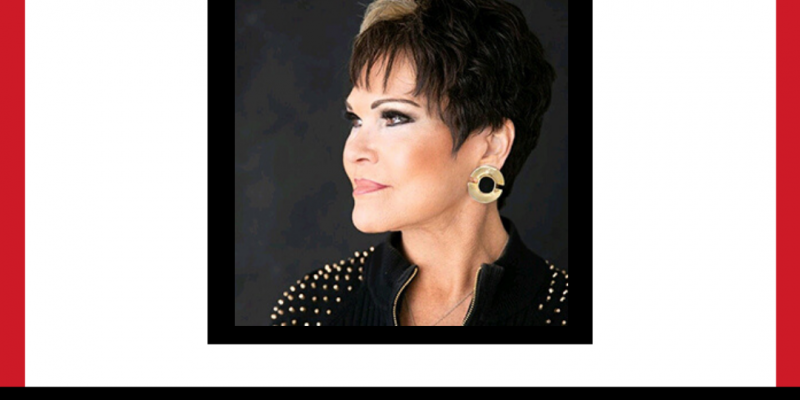

Financial Fitness Trainer Tracey Bissett joins us to explain how financial health can be improved just like physical health… and the practical building blocks to do so. She’s a passionate believer that financial literacy is a fundamental life skill, and preaches the lessons she has learned in her 20 years of experience in finance. Tracey is an expert in taking control of your financial life and living it with confidence. Chief Financial Fitness trainer of Bissett Financial Fitness, inc., she educates and empowers individuals, particularly young people and entrepreneurs, every day to improve their “Financial Health”.

She shared with us how your financial health can affect all other aspects of your life, the very first thing anyone with a great business idea should do, and how doing that upfront work will make any entrepreneur’s life easier. She also told us about the meeting she recommends you have with yourself every week – the ‘Money Meeting Agenda’ – which promises to improve your financial planning in just ten minutes at a time.

For more information and show notes visit: http://www.powerofthepursepodcast.com/podcasts-2/

Podcast: Play in new window | Download

Subscribe: Apple Podcasts | Spotify | Email | TuneIn | RSS | More